Tom Boyle was a CPA doing bookkeeping for small law firms in North Carolina when he decided there had to be better software for lawyers’ trust accounting. Most firms he worked with used either QuickBooks or Microsoft Excel, but both were cumbersome for lawyers to use and neither was well-suited to the fiduciary requirements of trust accounting.

So in October 2014, Boyle founded his own company and created his own trust accounting software, TrustBooks. TrustBooks is a cloud-based program designed to make trust accounting simple and foolproof for small and mid-sized law firms.

“We’ve tried to be very simple,” Boyle told me during a recent demonstration of his product. “We’ve taken the accounting language out of the mix. We let small firms get up and going without understanding complex accounting.”

After Boyle demonstrated the product, he provided me with one-month free access to a demonstration site preloaded with dummy matters and accounts.

The Problem with Other Accounting Programs

The problem with most accounting programs, Boyle believes, is that they are not designed for trust accounting or even specifically for the legal profession. They are soup-to-nuts programs designed for every industry. When a product tries to do everything, Boyle says, it cannot excel in any one thing. That is particularly true for trust accounting, where states set very specific rules and requirements.

Boyle has a number of concerns about QuickBooks, in particular, for trust accounting. For one, it is complex and cumbersome to use for many lawyers, requiring them to create charts of accounts and new sub liability accounts for each new client.

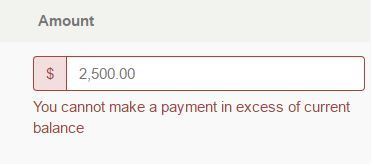

For another, it is designed around balance sheets and income statements, but not around clients and matters, as trust accounts should be, Boyle says. Using QuickBooks, a lawyer could overspend a trust account balance without knowing it. TrustBooks includes features that make it impossible to overspend an account, Boyle says.

With regard to Excel, Boyle says, the problem is that everything must be done manually. That means that the law firm needs to understand the trust rules and then know how to build them into a spreadsheet. “I had a firm that had over 100 tabs in Excel,” Boyle says. “To do a reconciliation, they had to pull subtotals from all those tabs into a summary tab. The risk of human error was astronomical.”

Using TrustBooks

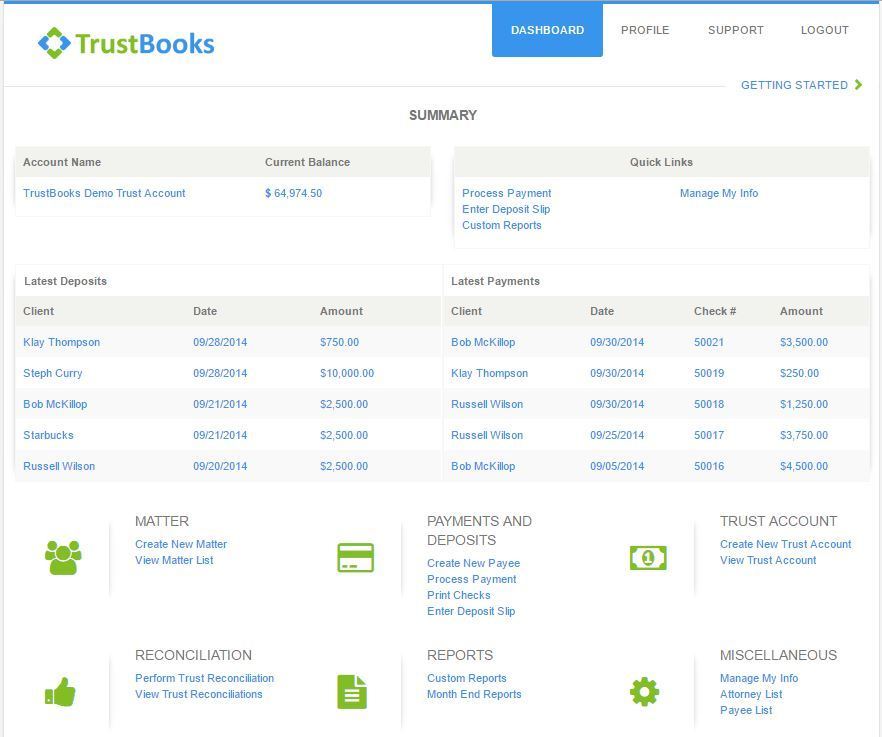

In TrustBooks, everything starts at the dashboard. Like every other part of TrustBooks, the dashboard features a clean and modern design. It provides an at-a-glance overview of your latest deposits and payment, quick links to common tasks, as well as a grid of action links organized within categories, such as “Payments and Deposits” and “Reports.”

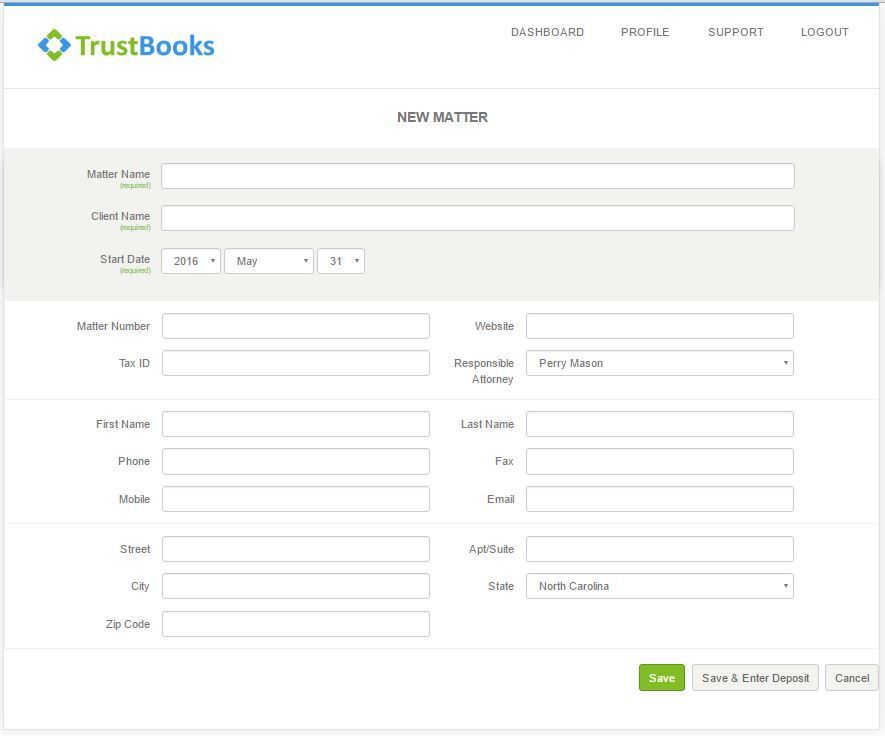

When a firm gets a new client, the first step in TrustBooks is to create a new matter. After you click the “Create New Matter” link on the dashboard, a form opens containing multiple fields for entering information about the client. Only three fields are mandatory to create a matter: Matter Name, Client Name and Start Date.

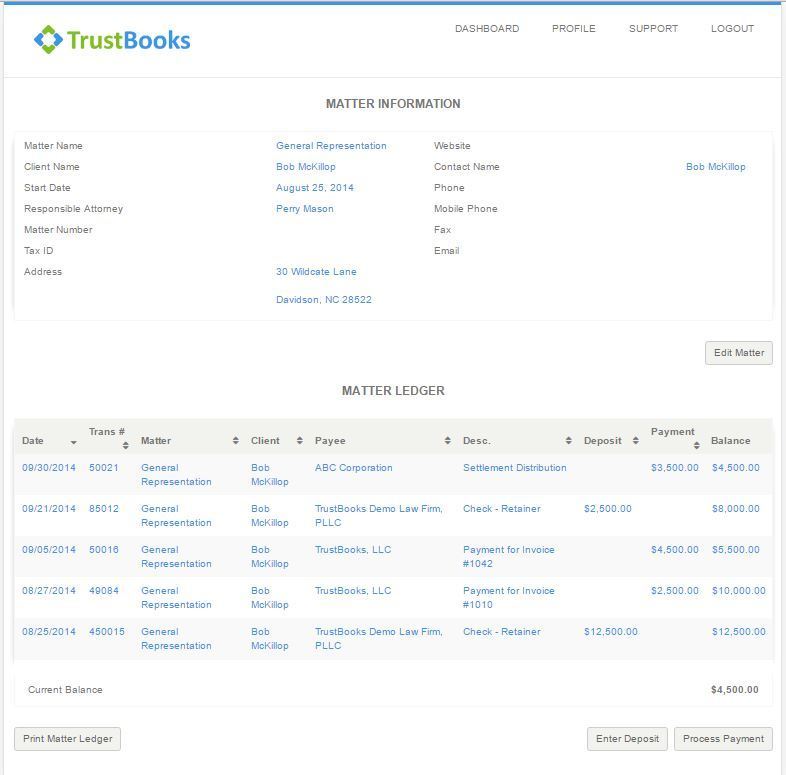

Once you create the matter, you are taken to the Matter Information page where you see the details you have entered and a ledger where the transactions for that matter will be listed. From this page, you can enter a deposit, process a payment or print the ledger.

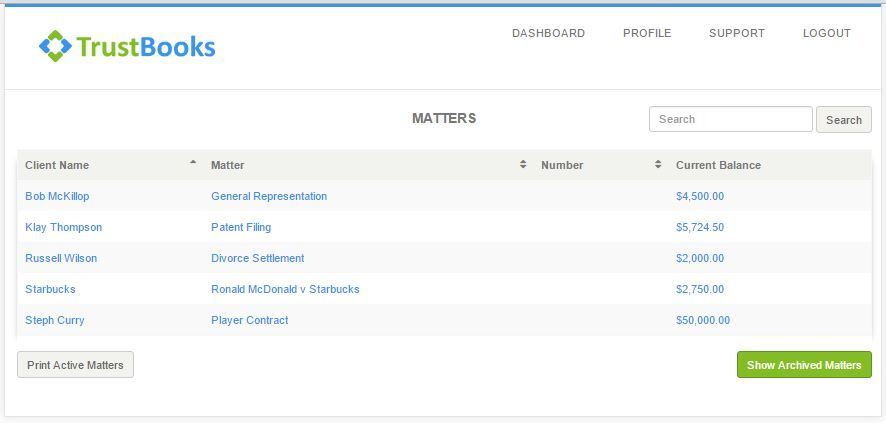

Another page, the matter list, shows all active clients and their current trust balances. Click on any of these to see the matter details and ledger page.

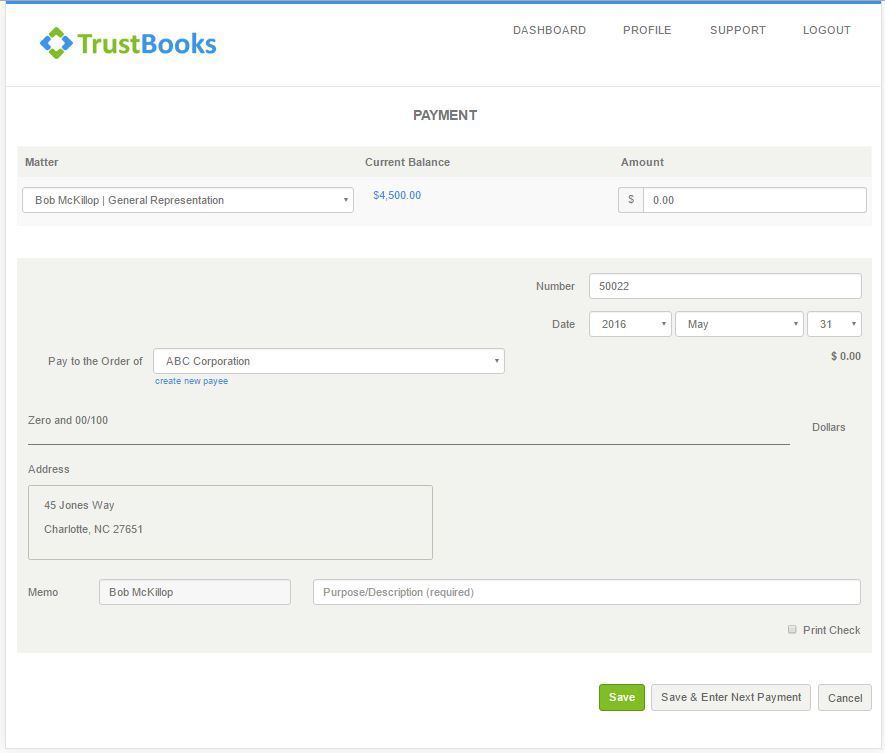

Back at the dashboard, a Process Payment links takes you to the page for making a payment from your trust account. Select the matter from a drop-down list, the amount, the date, and the payee, and then add a description, and you’re done. A check box allows you to use the information you’ve entered to print the check.

Notably, TrustBooks will not allow you to make a payment in an amount greater than the client’s available funds. If you attempt to do so, the system blocks the payment and warns, “You cannot make a payment in excess of current balance.”

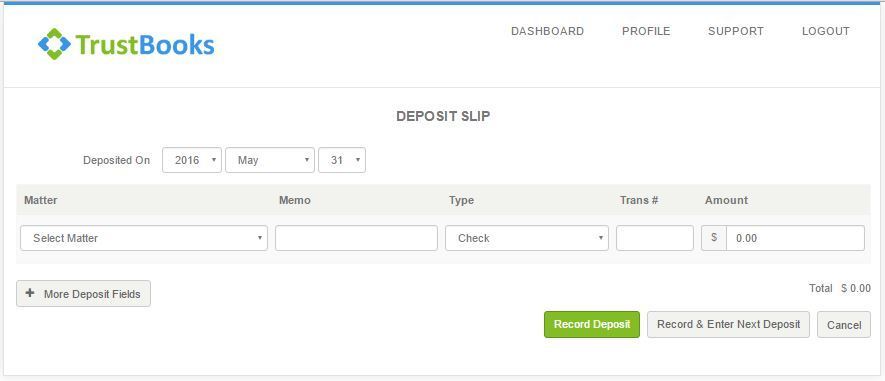

Entering a deposit is also a simple matter of selecting the matter, adding a memo, indicating the nature of the deposit (check, cash, wire transfer, etc.), the transaction number and the amount. If you have multiple deposits, then hit “Record & Enter Next Deposit” to add them.

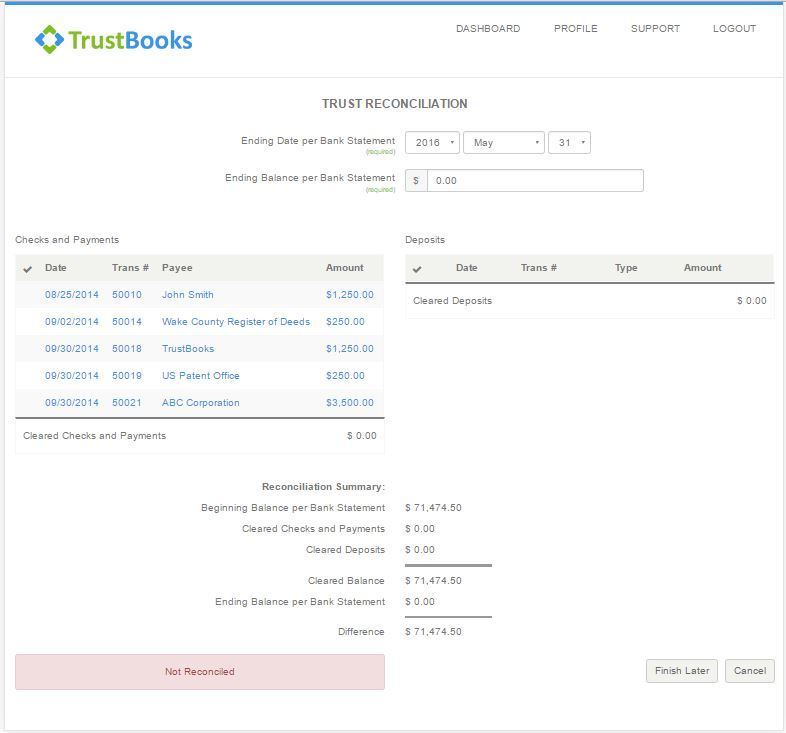

To perform a reconciliation, you click the Perform Trust Reconciliation button to go to the appropriate page. Using your bank statement, enter the statement date and ending balance. From the list of payments and deposits, select the ones that the statement shows as having cleared. If the system balance matches the statement balance, a message will show that the account is reconciled. The reconciliation is saved and can be viewed at any time. If they do not match, the page continues to display the message Not Reconciled.

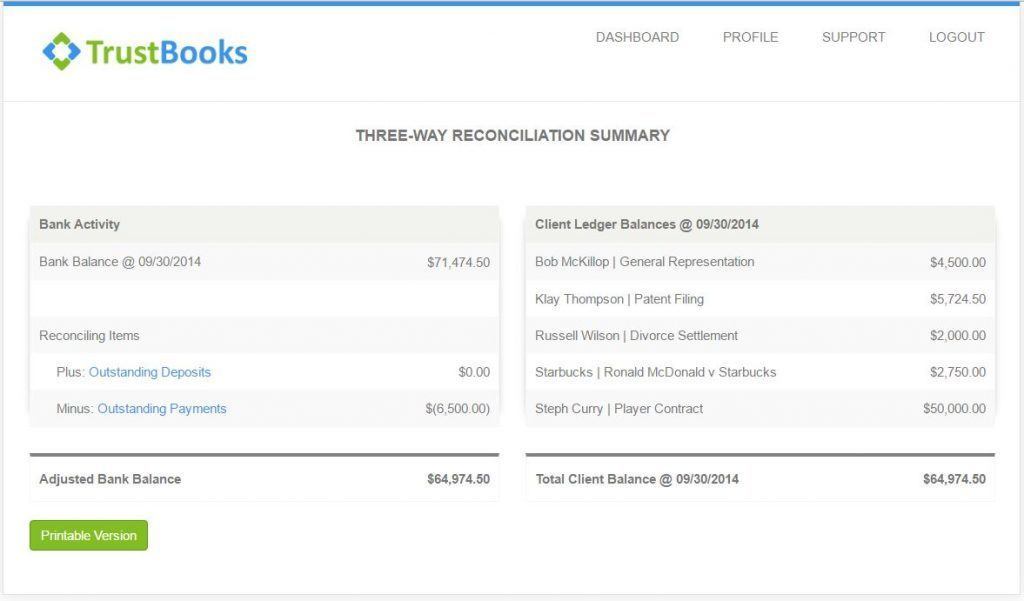

The system then automatically generates a three-way reconciliation. This reconciles the statement balance, the account balance and the individual client account balances. Needless to say, the bank balance and the total of all client balances should be equal.

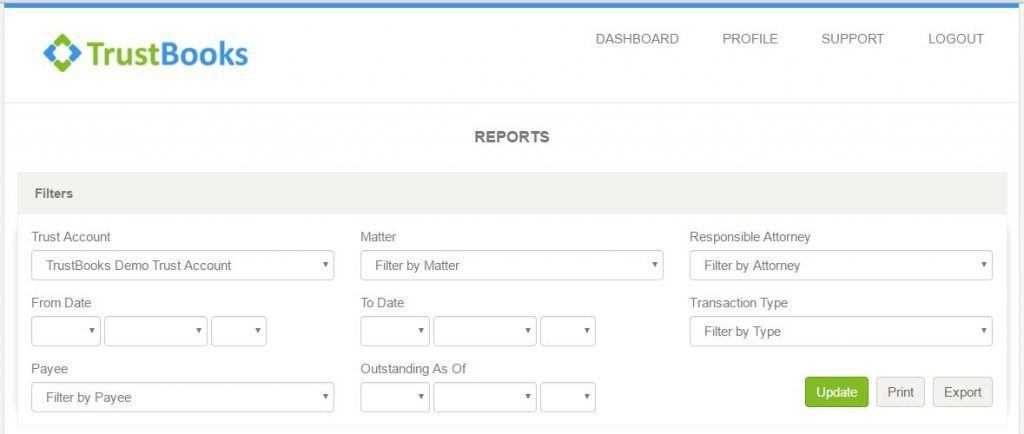

TrustBooks has several reporting features in addition to the reconciliation reports. It automatically generates month-end reports for payments, deposits, client activity and ledgers. Users can also create custom reports that can be filtered to show data only for specific date ranges, payees, transaction types, attorneys and matters.

TrustBooks is a standalone trust accounting program that does one thing and does it well. In my opinion, this product is ripe for integration with a third-party practice-management platform. Boyle does not rule out that possibility but says nothing is currently in the works. Even without such an integration, the simplicity of this program takes the pain out of trust accounting and makes it worth consideration by any firm in search of a better way to handle its trust accounts.

TrustBooks offers a 30-day free trial. If you then decide to purchase it, the per-user cost is $25 a month or $250 a year.

“History shows that attorneys don’t do a great job keeping and reconciling their trust accounts,” Boyle says. In its own simple way, maybe TrustBooks will help change the course of that history.

Robert Ambrogi Blog

Robert Ambrogi Blog