[Note: This is the first of an exclusive two-part series on lawyer marketplace UpCounsel, which – 16 months after new owners rescued it from shutting down – is now launching a crowdfunding campaign. The campaign opens to the public July 28, but readers of this blog can access the private friends and family campaign, with early investor benefits including a lower valuation cap.

Part two of this series, coming Monday, is an exclusive LawNext interview with UpCounsel’s CEO KJ Erickson and Chief Revenue Officer Paul Drobot.]

On Feb. 3, 2020, the death knell sounded for lawyer marketplace UpCounsel.

On that day, eight years after UpCounsel launched, cofounders Mason Blake and Matt Faustman emailed the company’s customers to tell them that it would shut down permanently March 4.

“It is with a heavy heart that we deliver this news and understand that this abrupt announcement will come as a shock to some of you that have come to rely on UpCounsel,” they wrote.

But then something unexpected happened. Two entrepreneurs, Sieva Kozinsky and Xavier Helgesen, came in at the eleventh hour and acquired the UpCounsel website. Helgesen was a fan of UpCounsel, having used it for his own businesses, which he estimated had saved him thousands in legal fees.

Kozinsky and Helgesen had just started a small private equity firm called Enduring Ventures, and they saw UpCounsel as an opportunity that aligned well with their investing goals.

“My past businesses relied on UpCounsel for legal work,” Helgesen wrote in a blog post announcing the acquisition. “We saved a ton of money using it! We were shocked when we heard UpCounsel was shutting down. So, because we’re such big fans, we bought UpCounsel to prevent the service from closing and to focus on expanding it.”

Sixteen months later, UpCounsel has overhauled its business model and says that it is profitable and poised to further disrupt the legal tech market. In its first 12 months under new ownership, it says, it has doubled its revenues and saved clients over $12 million in legal fees.

Now it has launched a regulation crowdfunding campaign aiming to raise as much as $5 million, with the mission, says its new CEO KJ Erickson, of taking law to the people. The crowdfunding campaign launched to friends and family last week and will open to the public on July 28.

[Readers can access the campaign now at: wefunder.com/upcounsel.]

Additionally, UpCounsel plans to roll out additional products and services and says it will eventually launch its own, UpCounsel-branded, full-service law firm.

Sixteen months after it nearly shutdown, UpCounsel says it is poised for spectacular growth.

An Abrupt Shutdown

News of the shutdown of UpCounsel came abruptly. On Feb. 3, 2020, founders Blake and Faustman sent an email to customers notifying them that the website would shut down on March 4 and thanking them for their support.

“Pursuant to a decision approved by our board of directors and shareholders, the UpCounsel website will be shut down permanently on March 4, 2020,” they wrote. “At that time you will no longer be able to login to your account.”

Exactly why they decided to shut down remains unclear. I reached out to both Blake and Faustman to speak with them. Only Blake replied, saying that he is now only “tangentially” involved with the company and providing no further comment.

However, after that surprise notice to their customers, Faustman later announced, on April 23, 2020, that he and Blake had joined LinkedIn as employees.

“This new chapter of working alongside the amazing team at LinkedIn presents boundless opportunities to extend the UpCounsel vision we created so many years ago to new and exciting horizons,” he wrote.

While he did not provide specific details of what he would do at LinkedIn, he indicated that it would be to extend the UpCounsel model across multiple industries.

“Building the vertical marketplace model honed by the UpCounsel team into LinkedIn’s platform and social graph, and then replicating it across 100 different industries opens up limitless potential to empower service providers around the globe,” Faustman wrote. “Of course, one of the verticals we will be developing and broadening is Legal.”

It had also been reported in the media that UpCounsel had struggled to grow its business and had been sidetracked fighting a lawsuit – since settled – that claimed the company violated California ethical prohibitions on sharing fees between lawyers and others.

An Eleventh-Hour Rescue

When entrepreneurs Xavier Helgesen and Sieva Kozinsky got word of UpCounsel’s shutdown, they saw an opportunity.

Helgesen had been an UpCounsel client in prior businesses and believed it had saved him thousands in legal fees.

“My past businesses relied on UpCounsel for legal work,” Helgesen wrote at the time. “We saved a ton of money using it! We were shocked when we heard UpCounsel was shutting down. So, because we’re such big fans, we bought UpCounsel to prevent the service from closing and to focus on expanding it.”

They had recently founded Enduring Ventures, a small private equity firm that focuses primarily on raising individual SPVs, or special purpose vehicles, that invest in a single company. Through Enduring Ventures, they acquired the UpCounsel website. They created a new company to operate it, UpCounsel LLC, and Helgesen took over as acting CEO.

Enduring Ventures did not acquire the former company, which had been acquired by LinkedIn. Rather, they acquired the website and its backend for supporting the service, along with the community of prior UpCounsel users.

Forming A Management Team

Soon after acquiring UpCounsel, Enduring Ventures brought in a new management team, led by serial entrepreneur KJ Erickson as CEO; Paul Drobot, who previously led sales at Atrium and Logikcull, as chief revenue officer; and Danny Page, an operations and growth professional, as vice president of operations.

Erickson is an experienced entrepreneur who was named by Rolling Stone in 2017 as one of 25 people shaping the future – a list that included the likes of Elon Musk and Kamala Harris. She was named to the list for her company Simbi, an online services marketplace with its own form of currency.

Earlier, at the age of 20, while working as a volunteer in refugee camps in Botswana, she dropped out of Stanford in her junior year to found FORGE, an international peacebuilding NGO. By the time she was 22, she had built it to 200 employees working in four countries.

Erickson – who along with Drobot sat down with me this week for an exclusive LawNext interview that will be posted on Monday – said that Enduring Ventures is unlike other investment firms in that it “doesn’t believe in sacrificing the business for growth at all costs.” Rather, she said, “They are looking for businesses that they can manage to profit and cash flow.”

A New Business Model

With this new management team in place, one of their first steps was to revamp UpCounsel’s business model. “The original founders had done such an amazing job setting the stage for success, and there were just a couple of things that needed to change to really drive this business over the hump,” Drobot told me during our interview.

The core business of UpCounsel is a marketplace where small businesses needing legal help can post jobs on the website and lawyers bid to be selected for those jobs.

Before the acquisition, UpCounsel generated revenue by charging clients a 30% commission on the fees they paid lawyers hired through the site. That meant that UpCounsel’s revenue fluctuated unpredictably based on variations in the number of engagements flowing through the system at any given time.

Seeking a steadier and more predictable revenue flow, the new management team flipped some of that cost to the attorneys, instituting a monthly subscription fee attorneys pay to be part of the service and to be able to bid on jobs posted on the site – something UpCounsel calls “legal-as-a-service” and which more closely aligned UpCounsel with a typical SaaS model.

At the same time, it significantly reduced the commission it charged clients to 8%, making legal services more affordable for them.

“We needed to take a business that was essentially closed, quickly formulate a plan, and then take that plan to market,” Drobot said. “And the complexities of that plan is it needed to address all of the challenges in the previous model and also allow us to help this business to truly realize its potential.”

In coming up with this plan, Drobot was helped by the fact that the UpCounsel platform provided detailed data on its users up to then. The new management team was able to see that attorneys who used the site fell into two distinct categories – intermittent users and power users. Those power users were on the platform regularly and had effectively incorporated it into their businesses, Drobot said.

“This was the group that was making us a part of their business and we wanted them part of our business, so we wanted that mutual commitment,” Drobot said. “We realized we could build a model around this.”

Initially, UpCounsel announced it would cap the number of attorney subscriptions. It sold out of those within two weeks. “That validated the great work that the founding team had done in building value in a platform like this and it validated the business model at the same time,” Drobot said.

Since then, UpCounsel seeks to maintain a balance between the number of attorney subscriptions it allows and the demand coming into the site for legal services. Its biggest problem now, Drobot says, is that demand has grown so great that it needs to bring in more attorneys to service all the matters.

Becoming Profitable

That new business model, UpCounsel says, has borne fruit, enabling the company to create a predictable and recurring stream of revenue. “Our new business model has transformed UpCounsel’s future with a hyperfocus on recurring revenue,” UpCounsel says on its crowdfunding site.

Erickson said that the company has doubled its revenue, seen its traffic explode, and has more jobs being posted than it can fill.

UpCounsel says it was profitable in its first 12 months of operation after taking over the company and that it is operating at a revenue run rate of $2.6 million.

Financial statements posted as part of the company’s crowdfunding site indicate that, on a net basis, the company actually lost money in 2020, with a net loss of $147,151 on revenue of $1,452,643.

But when measured on the basis of EBITDA (earnings before income, taxes, depreciation and amortization), profit was $191,000 for 2020 and $274,000 for the 12 months through May 2021.

“We use EBITDA to determine profitability because we have book losses due to the way we amortize the website assets that we acquired last year,” Erickson wrote on the crowdfunding page.

New Products Planned

Even as it has shored up its core legal marketplace, UpCounsel has been planning to launch several new products – and eventually to launch its own branded law firm.

While its attorney subscriptions was the first of its new products, within the next two months, it plans to launch another, Direct Connect, by which attorneys will pay to allow clients to contact and book them directly.

As Drobot described it, Direct Connect sounds like an easy button, which attorneys can place on their profile page, social media sites, articles they publish, and elsewhere. Potential clients will be able to click to connect to the attorney’s UpCounsel portal and describe their legal need, and the attorney can then reach out directly to the client to connect.

UpCounsel also plans to launch a corporate program, in which startup clients can get concierge service to help match them with attorneys for their specific client needs, and an enterprise concierge, through which global companies will be able to source in-house legal talent as needed.

It also plans to expand its core platform into new practice areas, including medical malpractice, personal injury and workers’ compensation, and thereby also further increase traffic to its site.

In addition, UpCounsel says that it plans to launch its own branded law firm, citing new lawyer regulations that will allow it to do this.

“By standing up our own branded law firm, we will be able to dramatically increase the rate of fulfillment of current inbound demand at very high margins without impacting current subscribers, leading to a 4-6x jump in revenues,” the crowdfunding page says.

Erickson and Drobot said that, for competitive reasons, they would not provide specific details at this point of their plans for a firm.

“We’ve done a lot of investigating of some very creative and interesting ways to help not only build UpCousnel for the long haul, but also to create the digital law firm of the future and what that may look like,” Drobot said.

“That can take a lot of different forms, but at the end of the day, the north star for us is how do we best serve those millions of entrepreneurs and individuals and small business owners that want fast, affordable, transparent access to great legal.”

The Crowdfunding Campaign

Amid all this, UpCounsel has launched a regulation crowdfunding campaign seeking to raise from $50,000 to $5 million, which is the upper limit allowed for such a campaign by federal securities law.

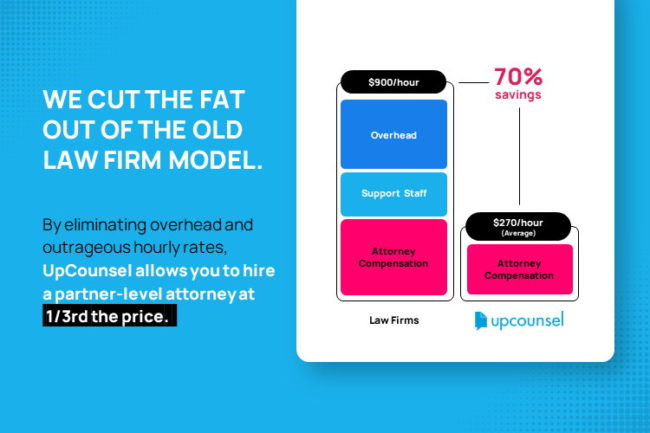

“We’re Bringing Legal to the People,” says the management discussion on the campaign’s WeFunder page. “The UpCounsel solution is simple: an online marketplace connecting businesses with a network of experienced independent attorneys – for 1/3rd the price. We remove the headaches and hassles for everyone, bringing you Legal You Can Love.”

“It basically gives us a chance to let our stakeholders buy into our success,” Erickson said, “and the more people we have that are shareholders in our mission and in our vision, the faster that we can grow it.”

She said it also offers a way to raise capital that circumvents many of the downsides of traditional venture capital.

In preparing for the campaign, the company recently reconfigured its corporate structure, transitioning from the LLC it formed when it acquired UpCounsel to a new entity incorporated in Delaware in June, UpCounsel Technologies Inc., which is 100% owned by Enduring Ventures.

The offering is of a form of security called a SAFE, or Simple Agreement for Future Equity. A SAFE gives an investor the right to obtain equity at a future date if certain trigger events occur, most typically if the company sells shares in a future financing.

The company’s SEC Form C, required for regulation crowdfunding, is available here. Copies of the early-bird and public SAFE agreements are appended at the bottom of that document.

The U.S. Securities and Exchange Commission has urged investors to be cautious of SAFEs in crowdfunding, writing, “Despite its name, a SAFE may not be ‘simple’ or ‘safe.’”

The important factor to understand about SAFEs is that they do not grant a current equity stake in a company. They convert to equity only if certain trigger events occur.

In UpCounsel’s case, those trigger events would be a future equity financing or a liquidity event such as a sale of the company or an IPO.

The crowdfunding page notes this risk:

“The Company may never receive a future equity financing or elect to convert the Securities upon such future financing. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an IPO. If neither the conversion of the Securities nor a liquidity event occurs, the Purchasers could be left holding the Securities in perpetuity.”

But Erickson said that the company is firmly committed to delivering a return for its investors.

“We are staunch believers that companies should only raise money if they are firmly committed to delivering a return for their investors,” she wrote in response to a question on the crowdfunding site.

In our conversation for LawNext, Erickson told me that UpCounsel’s current goal is to make a public offering within the next 3-5 years. This may not necessarily occur on a U.S. exchange, she said, but could come as a non-traditional offering on a smaller exchange, such as the Canadian Securities Exchange.

In the Q&A section of the crowdfunding site, she also said that “being acquired is certainly on the table” and that “several potential investors have already reached out.”

Money they raise in the campaign will go primarily to sales and marketing and product development.

What’s Ahead for UpCounsel

As it stands today, UpCounsel’s mission is twofold, said Erickson.

One is to bring legal to the people. “We believe it shouldn’t be only the wealthy who can afford to protect themselves in a contract dispute or start a business that depends on a patent,” she said.

The other is to make legal “something you can love.” Erickson said she has heard testimonial after testimonial from clients about how much they loved hiring an attorney through UpCounsel and how it enabled them to get their businesses off the ground when they would not otherwise have been able to afford legal help.

Looking to the future, UpCounsel believes it is well positioned to take advantage of the accelerating legal tech market, which is predicted to be on track to surpass $25 billion in revenue in 2025.

It is predicting annual growth of over 100% and Drobot said he expects it to continue to at least double its revenue every year, reaching a revenue run rate in 2025 of $44 million.

All of this leaves Erickson believing that UpCounsel can truly change the paradigm for delivering legal services.

“We basically cut all the overhead and the fat out of the old, bloated big law firm model and we make it easy and fast and reliable to hire partner-level attorneys at literally a third the cost of going through big law.”

Robert Ambrogi Blog

Robert Ambrogi Blog