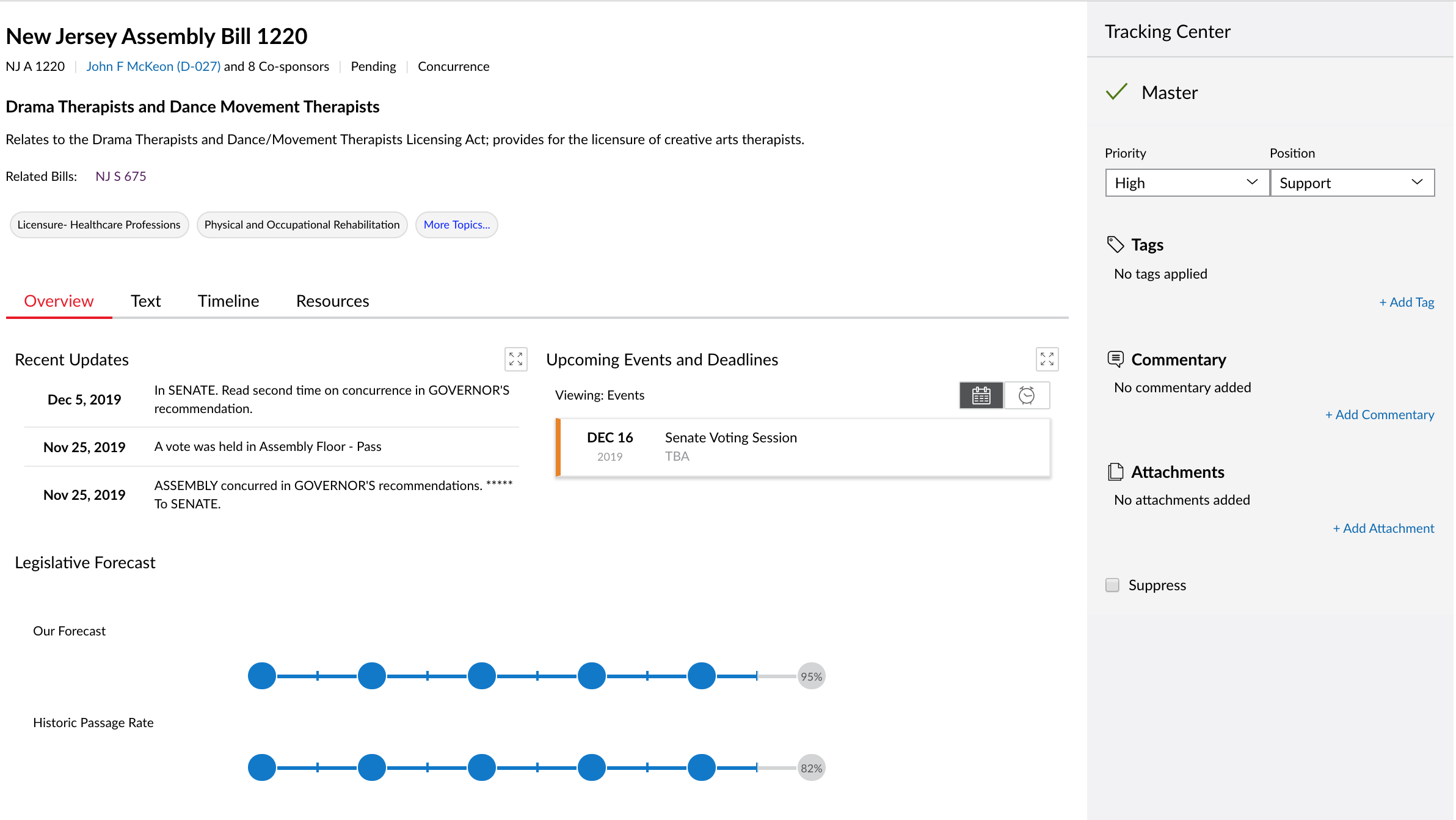

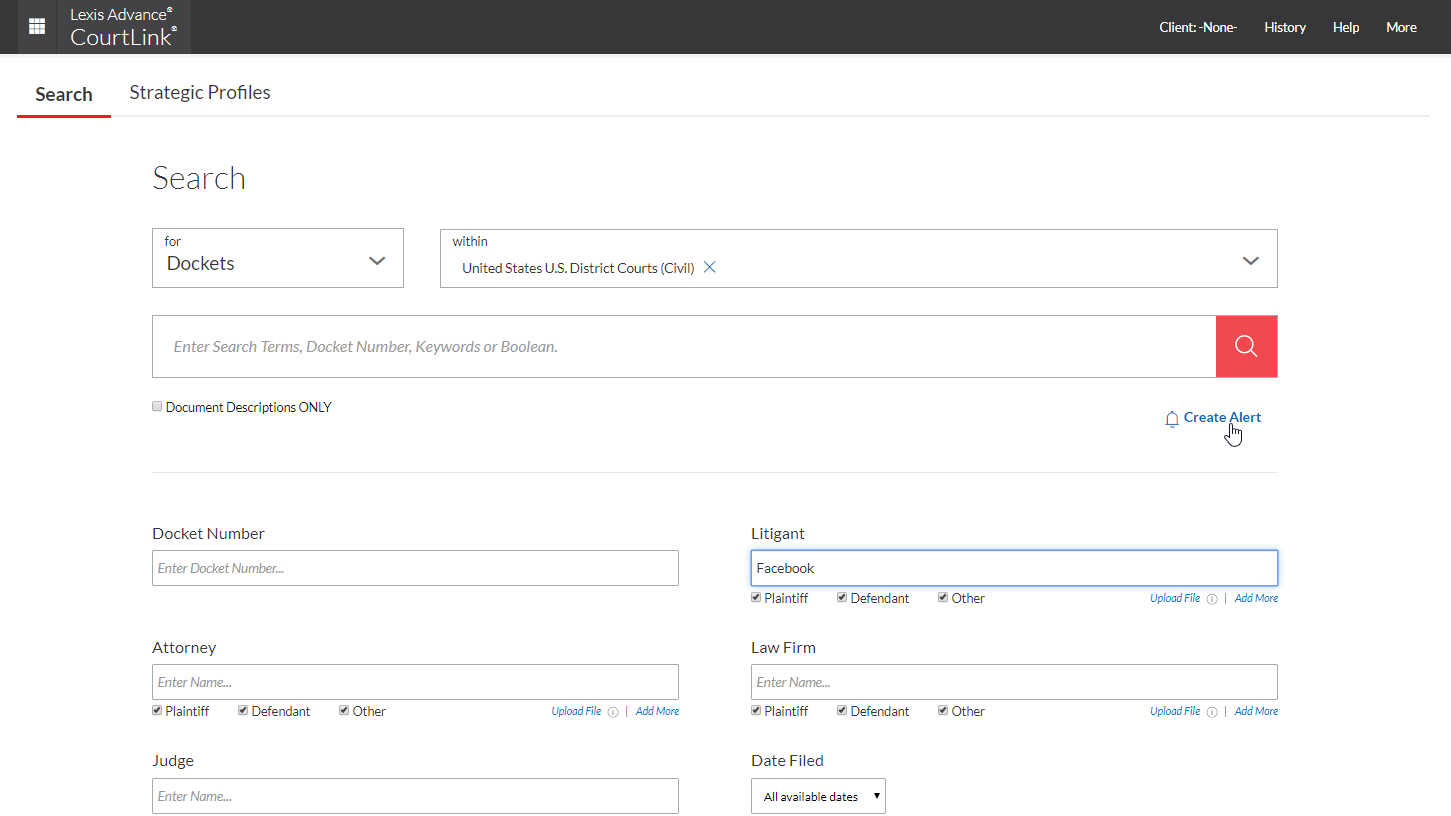

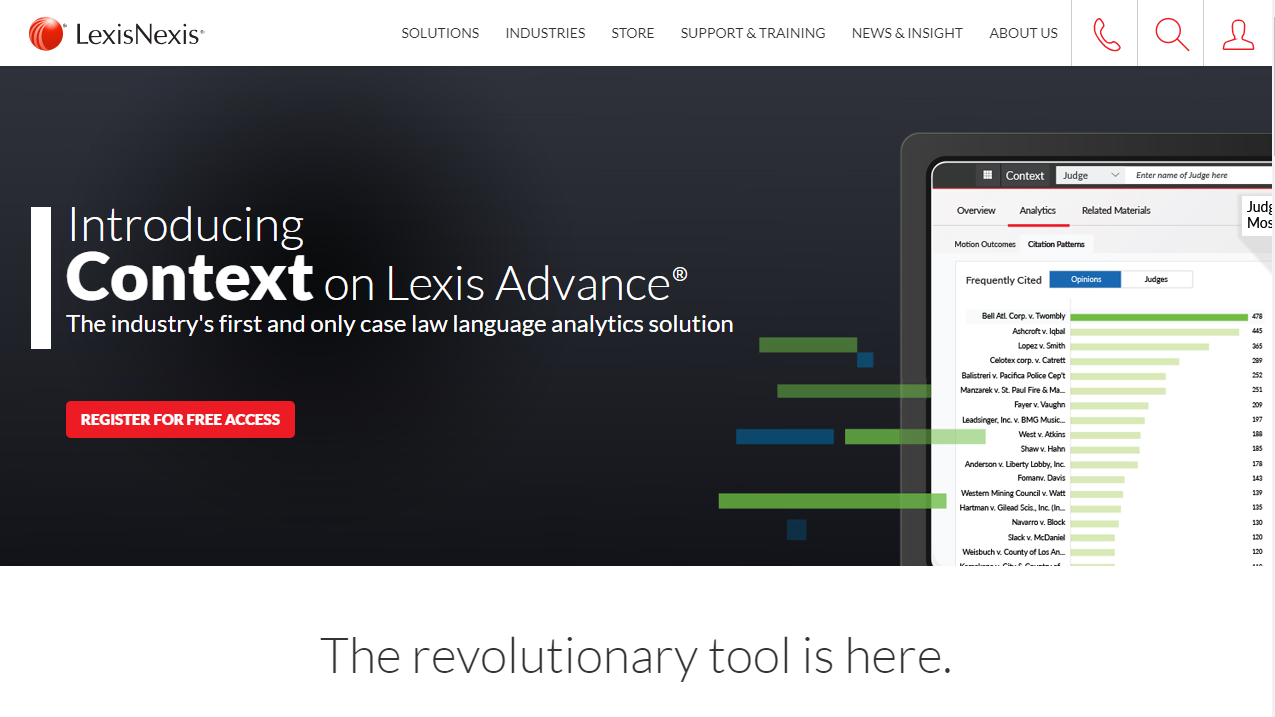

The legislative tracking service State Net, which is owned by LexisNexis, is marking its 50th year in business by rolling out upgrades to its infrastructure and search and new analytics.

Founded 50 years ago in Sacramento, Calif., State Net was acquired by LexisNexis in 2010. Two years ago, LexisNexis put Daniel Lewis, vice…

Robert Ambrogi Blog

Robert Ambrogi Blog