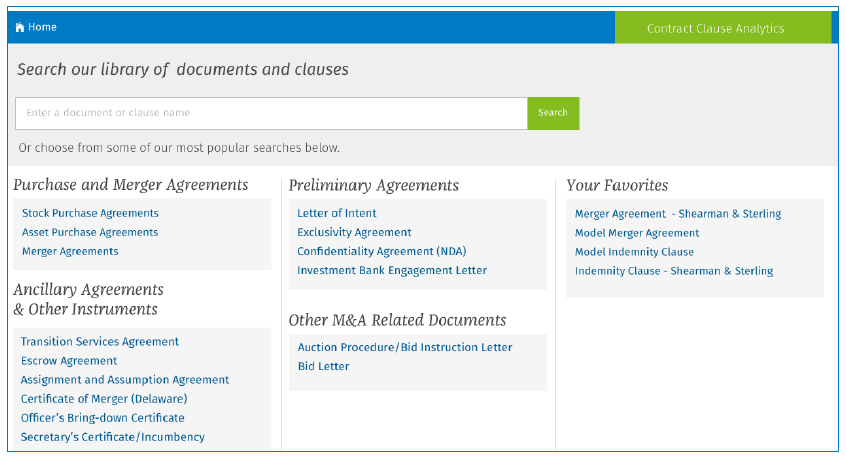

The home page of M&A Clause Analytics

At the annual convention next week of the American Association of Law Libraries, Wolters Kluwer Legal & Regulatory will unveil two new features of its Transactional Law Suite for Securities. One, M&A Clause Analytics, uses analytics to help streamline the process of drafting documents for mergers and acquisitions. The other, RegReview, is designed to boost the efficiency of SEC rule checking.

Both are additions to WK’s Securities Transactional Law Suite, which provides tools for researching SEC filings and for document drafting and due diligence. The suite also includes RBsource and RBsourceFilings, for researching and tracking securities laws and filings, and Clarion, a tool for M&A due diligence and strategic advisement.

M&A Clause Analytics

M&A Clause Analytics uses a combination of artificial intelligence and subject-matter expertise to provide a market standard for a range of acquisition agreements, clauses and related documents. The purpose is to provide M&A lawyers with access to a vetted set of market standard M&A documents they can use to streamline and verify drafting.

WK developed the set of documents using two steps. First, for each type of agreement, it used a machine learning algorithm to create a composite model derived from a sample set of 250 documents chosen by its M&A editors. It then had M&A attorneys review the composite document and perform the final editing and curation.

The drafting attorney can then use this model as a benchmark to compare a single clause or an entire agreement against what has been identified to be the market standard. It shows the extent to which clauses are or are not most conforming to the market standard. It also provides practical guidance around each clause.

The product includes merger, stock purchase and asset purchase agreements. Lawyers can search from the home page to find on-point agreements and clauses, and then use the “select and analyze an agreement” function to learn the extent to which the selected agreement’s clauses conform to the market standard.

The product includes expert-prepared practical guidance for critical issues on a clause-by-clause basis. Also, for each clause, it provides analysis of three key considerations: difficulty of drafting, legal mistake/risk, and standard versus negotiated. The product identifies any of these that are outside the norm so that the attorney can address them.

“This offering breaks new ground through the combination of artificial intelligence with expert attorney curation, driving both improved productivity and better client outcomes,” said Dean Sonderegger, vice president and general manager, Legal Markets & Innovation, in a statement issued by the company. “The launch of M&A Clause Analytics is Wolters Kluwer’s latest move to enhance our best-in-class transactional offerings by integrating its deep legal expertise with the best in emerging technology, content curation and aggregation and seamless workflow integration.”

RegReview

RegReview is designed to address to major pain points for securities lawyers in drafting securities documents. One is the difficulty of identifying changes in the laws, regulations and forms. The other is “rule checking,” the systematic review of all relevant law governing the SEC filing being drafted.

RegReview addresses these pain points in two ways:

- By providing “Point-in-Time” analysis of the law that lets the attorney see which regulatory content has changed and the exact text of the changes. It does this by letting the attorney compare versions of all changes made since 2013 to the laws, rules, regulations and forms, using WK’s RBsource and RBsourceFilings. This lets the lawyer quickly see whether or not the law has changed since a given point in time.

- By integrating forms with all associated regulatory content. When a lawyer opens a filing, such as a Form 10-K, RegReview will show all the rules, guidance and other materials that its content experts have identified as associated with that form. This gives the lawyer a comprehensive view of what needs to be reviewed before working on the filing. This will be available for four types of forms: the registration statement, the 10-K report, the 10-Q report, and the 8-K report. (This associated content feature will not be available next week but will become available in September.)

Thus, before drafting a form, the lawyer will be able to easily navigate to all laws, regulations and SEC guidance. By clicking on any of the linked items, the lawyer will be able to see what changes there have been to any relevant regulatory materials and when those changes occurred.

Wolters Kluwer will be showcasing both of these tools at the AALL annual meeting in Austin next week.

Robert Ambrogi Blog

Robert Ambrogi Blog